Strovemont Capital Review 2025 – Intelligent AI Trading for Disciplined Investors

The rapid evolution of financial markets has created a growing demand for platforms

that help investors trade with structure, clarity, and reduced emotional pressure.

Strovemont Capital enters this space as an AI-assisted trading platform

designed to support informed decision-making through data analysis and algorithmic execution.

Instead of relying purely on intuition or constant manual monitoring,

Strovemont Capital focuses on intelligent systems that assist users

in navigating market movements more systematically.

In this Strovemont Capital Review 2025, we take a closer look at

how the platform works, what it offers, and why it may appeal to traders

seeking a more disciplined approach.

What is Strovemont Capital?

Strovemont Capital is a digital trading platform that integrates

artificial intelligence into market analysis and trade execution.

The platform aims to help users identify opportunities, manage risk,

and execute strategies with greater consistency.

Its core focus includes:

— AI-supported market insights;

— algorithmic trade execution tools;

— access to multiple asset classes;

— structured onboarding for new users;

— emphasis on disciplined, rule-based trading.

This structure allows traders to participate in markets

with a clearer framework rather than reactive decision-making.

Key Features of Strovemont Capital

Strovemont Capital provides a set of features designed

to enhance efficiency and reduce emotional trading behavior.

AI-Based Market Analysis

The platform applies artificial intelligence to analyze price movements,

historical data, and market trends.

This helps users interpret market conditions

and identify potential setups based on data rather than speculation.

Algorithmic Strategy Support

Strovemont Capital offers algorithmic tools

that assist with executing predefined trading strategies.

This helps traders follow their plans more consistently,

especially during volatile market periods.

Multi-Asset Trading Environment

Users can access different markets through the platform,

supporting diversification across instruments

and trading styles.

Intuitive Interface and Learning Support

The platform features a clean interface with dashboards

that clearly display key performance indicators.

Educational materials and onboarding guidance

help users understand the system efficiently.

How Strovemont Capital Works

The platform follows a structured workflow

designed to balance simplicity with advanced functionality.

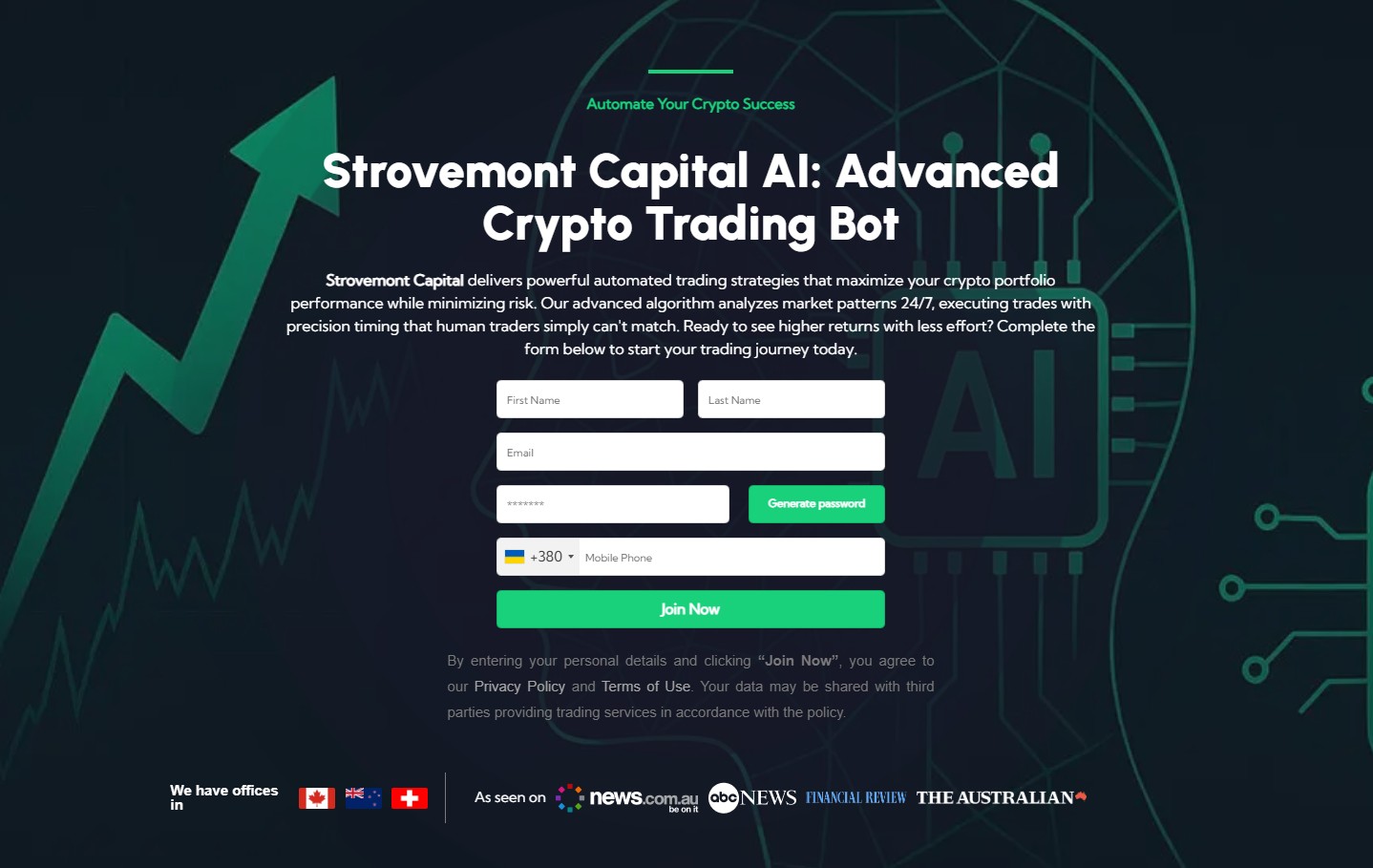

1. Create an Account

Users register to access the trading dashboard,

analytical tools, and platform features.

2. Verification and Security

Identity verification helps ensure account security

and supports a compliant trading environment.

3. Fund the Account

After verification, users deposit funds.

Entry requirements are typically designed

to allow gradual participation.

4. Configure Trading Strategies

Users set up AI-assisted or algorithmic strategies

according to their risk tolerance and trading goals.

5. Monitor and Refine

Traders can monitor results through the dashboard

and refine strategy settings as market conditions change.

Pros & Cons

- 📈 AI-assisted analysis supports data-driven trading.

- 📈 Algorithmic execution tools help reduce emotional decisions.

- 📈 Access to multiple markets enables diversification.

- 📈 User-friendly interface suitable for beginners.

- 📈 Structured trading framework promotes discipline.

- ⚠️ No guaranteed returns — trading always involves risk.

- ⚠️ Technology reliance requires understanding system behavior.

- ⚠️ Market volatility impacts performance regardless of tools.

Is Strovemont Capital Legit?

From an analytical standpoint, Strovemont Capital demonstrates

several indicators commonly associated with legitimate trading platforms:

— transparent use of AI and algorithmic tools;

— realistic positioning without guaranteed profit claims;

— emphasis on risk management and disciplined strategies;

— structured onboarding and platform clarity.

As with any trading platform, users should perform their own due diligence,

review platform documentation carefully,

and trade with capital aligned to their risk tolerance.

FAQ

Is Strovemont Capital suitable for beginners?

Yes. The platform offers onboarding guidance and a clear interface,

making it accessible to new traders.

Does Strovemont Capital guarantee profits?

No. Market conditions and strategy execution

determine results, and risk is always present.

What markets can be traded on Strovemont Capital?

The platform supports access to multiple markets,

allowing users to diversify their trading approach.

Can strategies be adjusted after setup?

Yes. Strategy parameters can be modified

through the platform dashboard.

Is Strovemont Capital designed for short-term trading?

The platform supports structured strategies

that can be adapted to both short- and longer-term trading styles.

Conclusion:

Strovemont Capital offers a disciplined,

AI-assisted trading environment designed for users

who value structure, data-driven insights, and controlled execution.

With its algorithmic support, multi-market access,

and user-friendly design, the platform may appeal

to traders seeking a more systematic way to approach

financial markets in 2025.

Leave a Reply